Understanding the travel intent of Muslim consumers is pivotal for industries ranging from hospitality to aviation. The HalalTrip Muslim Travel Intent Tracker (MTIT) is a strategic tool to gauge these trends. As the world continues to adjust to the new norms of travel in 2023, the MTIT provides invaluable insights into Muslim consumer behavior. This September MTIT data and analysis will unpack the nuances of the MTIT for September 2023 and extend the analysis to predict trends for the fourth quarter of the year.

You can read the Muslim Travel Intent Tracker (MTIT) reports for the other months here

The MTIT score represents a quantitative measure of travel intent among Muslim consumers. It indicates the level of interest and willingness among respondents to engage in travel activities within the next six months.

The decrease in September's MTIT score to 76.8 is due to the seasonality of the travel market. July and August are peak travel months, primarily driven by school holidays. Families are more likely to travel during these months, leading to a high MTIT score. The subsequent dip in September reflects the cyclical nature of consumer behavior.

The dip could also signal the end of what can be considered the "high travel season" in many parts of the world. With schools resuming and families settling back into their routines, it is natural for the travel intent to decline, at least in the short term.

One of the most critical data is the respondents' intent to travel "This Month," which offers a snapshot of immediate travel intent among Muslim consumers.

Key Observations of Data from February 2023 through to September 2023:

Looking Ahead: Predictions for Q4 2023

As we approach the end of 2023, we eagerly anticipate our upcoming travel plans for the remaining months of the year. Our predictive analysis provides a forecast for the next three months.

Key Forecasts:

Strategic Takeaways:

The predictive analysis for the intent to travel "This Month" category offers an immediate glimpse into the future, providing businesses with actionable insights.

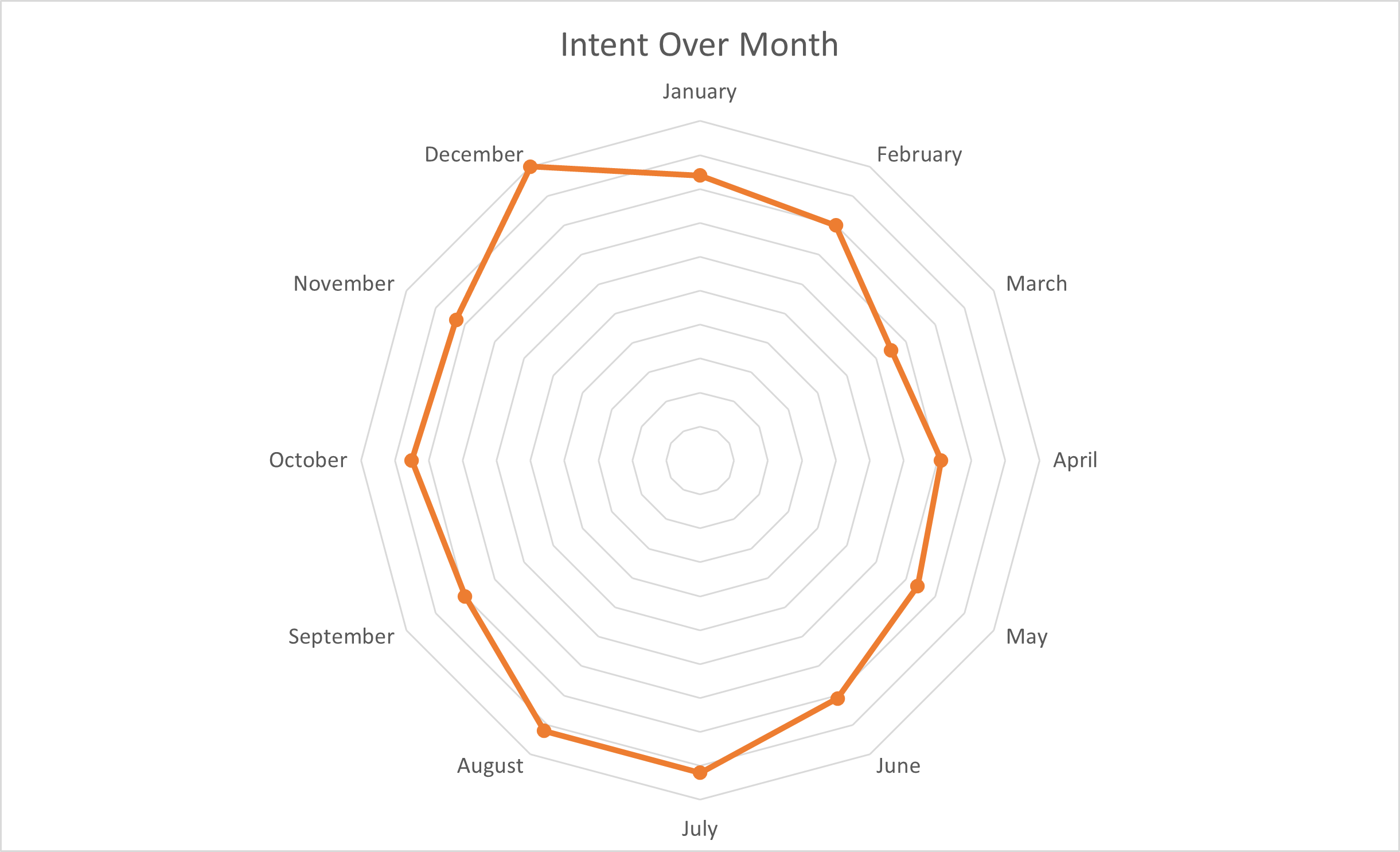

We have used a radar chart based on historical data from MTIT to compare travel intent across each month. The chart shows each month's travel intent relative to December, which has the highest intent.

Key Insights:

Strategic Implications:

Understanding these relative travel intent values provides a nuanced look at Muslim consumer behavior throughout the year. It enables businesses to tailor their strategies to match the travel market's natural ebb and flow, maximizing opportunities and mitigating risks.

While immediate travel intent offers a snapshot of current consumer behavior, the "After 1 month up to 3 months" category provides a glimpse into the near future. This timeframe is particularly relevant for those planning trips that require a bit more preparation but are pretty close, such as seasonal getaways or extended weekends.

Key Observations: This category often sees stable percentages, suggesting a consistent level of mid-term planning among consumers. However, transitional months like September and April may vary as travelers consider their next seasonal getaway.

Strategic Takeaways: Businesses can capitalize on this mid-term planning by offering early bird promotions and flexible travel packages. Since this group is in the planning stage but has yet to be committed, targeted marketing efforts could effectively influence their travel choices.

The "After three months up to 6 months" category sheds light on longer-term travel intent, capturing a segment of travelers planning well in advance, possibly for major holidays, significant life events, or extended vacations.

Key Observations: This category tends to see incremental changes, often influenced by upcoming seasons or significant events. It offers a glimpse into how far in advance people are willing to plan, and it usually spikes before major travel seasons like summer and end-of-year holidays.

Strategic Takeaways: This data suggests an opportunity for businesses to offer advanced booking discounts and comprehensive travel packages. These travelers are in the early planning stages, so informative and inspirational marketing campaigns could be particularly effective.

In the MTIT surveys, the participants are questioned about the destinations they planned to visit. The word cloud shows the aggregated results of the surveys conducted from February to September 2023.

The top response for desired travel destinations is Saudi Arabia, most likely showing a strong desire to perform Umrah. Spain, known for its rich Islamic history, remains popular, as does Canada, with its stunning natural landscapes and vibrant cities like Toronto and Vancouver. Singapore is also gaining popularity as an Asian destination.

The MTIT serves as more than just a barometer of Muslim travel intent; it's a valuable predictive tool that can influence a range of sectors, from tourism to retail. By understanding the September 2023 MTIT score and predicting trends for the fourth quarter, industry stakeholders can better align their strategies to capitalize on consumer behavior. Whether it's airlines adjusting their routes or travel agencies tailoring their packages, the data-driven insights from this analysis offer a competitive edge in a dynamic market.

Read our collection of Muslim Travel Intent Tracker (MTIT) reports for different months here: